The life cycle of lithium-ion batteries – It’s complicated

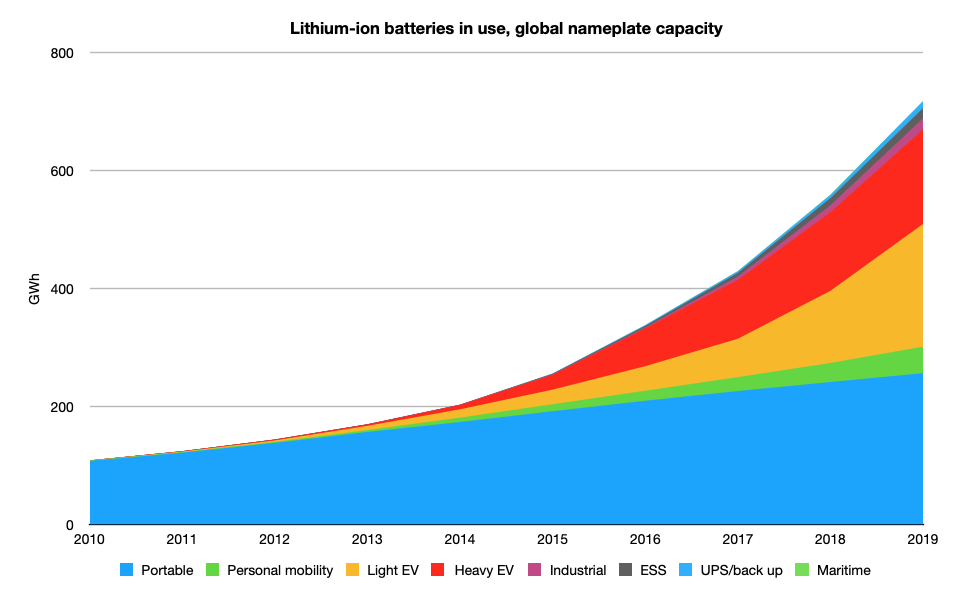

In 2019 the total installed capacity of lithium-ion batteries in the world exceeded 700 GWh. Of this 51% was installed in light and heavy duty electric vehicles. In 2015 that share was 19% and in 2010 it was less than 1%. The results are part of the findings in our new publication “The lithium-ion battery life cycle report 2021” covering what happens with lithium-ion batteries when they are placed on the market, how they are used, reused and recycled. The report contains the background research we are doing at Circular Energy Storage Research & Consulting and the aim has been to convey our insights for a better understanding of the dynamic and complex life cycle of lithium-ion batteries.

That a segment which barely existed 10 years ago now make up more than half of the installed capacity – not the annual sales – illustrates more than anything what the electric vehicle segment means for the lithium-ion battery industry. It also illustrates another important development. That the cells which more or less contain the same blend of materials as the cells inside portable devices with life cycles between 3 and 10 years, now are installed in equipment that will last twice as long. Our research shows that batteries might be used in cars in over 20 years, although the cars they power, will not be utilised as much as it was in its early years.

From a circular economy perspective this difference is very important.

First of all it’s great. Except for non-consumption nothing creates less environmental impact than a product that only rarely needs to be replaced. Unless it’s very inefficient that is. However, over the next 20 years it’s hard to think about an electric vehicle as inefficient as an old EV essentially always is replacing an old ICE vehicle.

Secondly, it’s complicated. Besides being optimised for durability, products that are designed with circular principles in mind should be easy to reuse and recycle. But the ease to take something apart fades in importance if the hassle to consolidate the disassembled components is too big. And that hassle usually grows with the age of a product. Because when products age they usually also are spread out. This has already been the case for portable devices, which throughout their life time are traded multiple times, meaning they end their life in markets far from where they were originally sold. The same thing is happening with cars, and electric cars are no exception. In both cases the batteries are only passengers on the journey the products take.

Thirdly, it may be very wasteful. Our research shows that the main reason for why batteries last much longer than what many have expected is that they aren’t used that much. Essentially because most people aren’t driving that far every day but also because when the product age we tend to use it less. That doesn’t mean that the car can’t do the job we hired it for. Because if the range is limited it might still be good for local trips which might be exactly what we need it for, especially if we have another car that can be used for longer trips. This is the reason why cars rarely lose their value even after 20 years. Unless the car has malfunctioned to the extent that the value of the repairs exceeds its value it will remain on the road or at least on the driveway. But it does mean that the batteries in most cars are under-utilised over their lifetime while they could have been used much more efficiently.

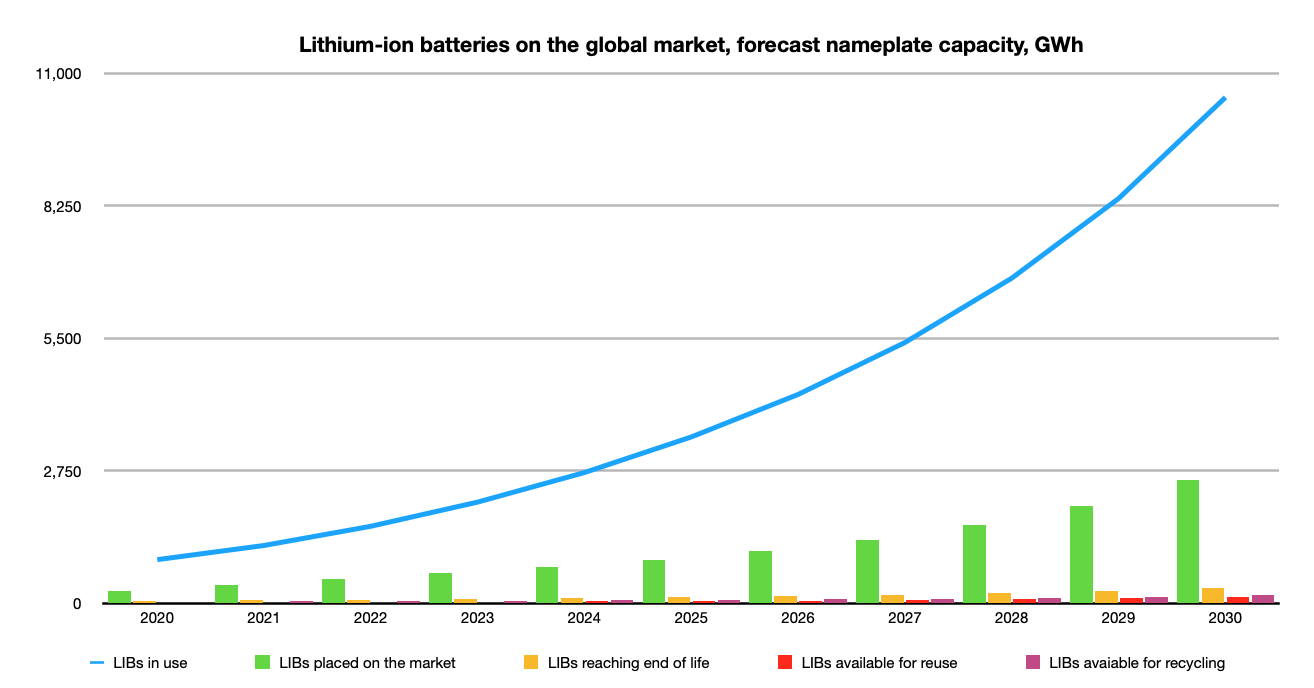

In our report we estimate that the annual volumes of batteries placed on the market will grow with a CAGR of 25.45%, taking the installed capacity of lithium-ion batteries in 2030 to 10.5 TWh of which 8.1 TWh, or 77%, will be installed in electric vehicles. That is 8.1 TWh of which a substantial part, if all vehicles were equipped with bi-directional charging, could have been used as energy storage for the grid as well as for homes and work places.

The amount of batteries reaching end of life will grow slower, from 47.7GWh in 2019 to 314 GWh in 2030, a CAGR of 18.8%. That’s what happens when you place batteries in longer lasting products.

Of this amount most of the batteries will be reused before they are recycled. Because even batteries which are 10-20 years will most often find buyers that prefer to capture value from using the remaining capacity in the packs or cells. And those buyers will always pay more than somebody with the intention to recycle them. The reuse applications might be very different from the concepts we have seen with 100s of packs consolidated in large stationary energy storage systems. Because every year that is added to a battery’s life will cause an increase in variations of the battery performance and widen its geographical spread. In our report we show that a third of several Nissan Leaf Models already have left both Germany and the UK to be found in markets such as Ukraine, Jordan, Sri Lanka and New Zealand. Markets where 1000s of EVs from the US are found as well. Therefore we predict that reuse for a long time will be small scale business ranging from battery replacements in cars to DIY projects and small scale energy storage products.

In 2030 we predict that the total amount of lithium-ion batteries that will go to reuse will be 145 GWh or 799,000 tonnes while 170 GWh or 820,000 tonnes will be available for recycling. Of the latter only 16% will be available in Europe and only 10% in the US. While this might look like more batteries are going to recycling than to reuse it is mostly an effect relating to that the most EV batteries are still in the cars. Because as batteries with shorter lifecycles such as cells and packs in portable devices and personal mobility vehicles will be reused to a lesser degree than packs and modules in EVs these batteries dominate the recycling volume while EV batteries dominate the reuse volume.

That batteries are available for recycling in a market doesn’t mean that they will be recycled there and today it is more likely that batteries available for recycling will travel from Europe and the US to Asia than the other way around, adding to the regional imbalance. The current global recycling capacity exceeds the total volume of waste material from LIBs, also when battery production scrap is included. The distribution is however uneven with significant overcapacity in China and a few Southeast Asian markets while there is under capacity in Europe and North America. In a few years time this is about to change and in 2025 all larger lithium-ion battery markets will have recycling capacity that greatly exceeds the supply of waste batteries and production waste, given that planned and predicted expansions will go ahead. The fear of tsunamis or mountains of unprocessed waste are therefore completely unfounded.

Over the next years several technical, regulatory and economical changes are expected in the market, including introduction of new battery technologies, the emergence of autonomous vehicles and new ownership models of both vehicles and batteries. However with the long life times of the batteries and with no substantial changes in sight the coming years, none of these changes are predicted to have a meaningful impact of neither the volumes of batteries in use, nor the end-of-life volumes during the coming decade.

In a sense the lithium-ion battery is already very circular as a product. They last for a long time, they are reused and recycled. However the circles looks very different to what policy makers, academics and NGOs often suggest as batteries are being used and reused without control and visibility for our societal institutions and control systems. To change that through direct legislation for collection, recovery rates or requirements of recycled content in batteries is most likely not a very efficient or even sustainable way forward. What really drives volume is value. If an activity can create more value than another it will gain access to the resources. There is a big potential for business model innovation not least in order to eliminate obstacles in the value chain such as high upfront investments, negative values on end-of-life batteries and low efficiencies due to insufficient scale in various processes. There is also a potential to better monetise the batteries throughout its lifetime through processes like vehicle-to-grid and second use of batteries. Legislation can support this development. However so far we haven’t seen much of this happening.

What we have seen are players in the market which have understood how to create value in the market place and which already are efficiently monetising the batteries in various part of the value chain. These players include recyclers, remanufacturing and second life specialists, as well as vehicle makers with technology and strategies for vehicle-to-grid integration. It is our belief that these players will be able to generate significant growth over the next ten years although they will still make only a small dent in the volume development before 2030.

Our publication “The lithium-ion battery life cycle report 2021” is based on over 1000 hours of research on how lithium-ion batteries are used, reused and recycled. It cover both historical volumes and forecasts to 2030 over 90 pages with more than 130 graphs and 20 data tables. The report is available to our subscribers of CES Online where more data on volumes, prices and market players is available. It can also be accessed through a one-month subscription. Read more about the report here